If your company is planning to enter the Taiwanese market, you may be interested in hiring employees in Taiwan to test the market before fully establishing your business.

This article provides information on many significant elements related to this before you do the actual hiring, to make your journey as simple as possible!

This article is provided by our trusted partner NNRoad, a US-based company that provides services like company formation, employment outsourcing, payroll, tax, and accounting for companies interested to expand globally.

Company Requirement for Hiring Employees in Taiwan

Companies that do not have a legal entity in Taiwan cannot hire employees. If a foreign company wants to hire an employee in Taiwan before they set up a legal entity, they must hire the employee through an Employment Solutions / PEO (Professional Employment Organization) provider.

What if I don’t have a company established in Taiwan?

Hire Employees in Taiwan through a PEO / Employment Solutions

The use of employment solutions consists of outsourcing all employment liabilities to a local HR agency, while the foreign company remains responsible for managing its workforce.

Employment solutions enable companies to enter the Taiwanese market in a very cost-effective way, as company formation procedures are not required. It also allows companies to mitigate the risk, because all liabilities are taken by the local HR agency, called a Professional Employer Organization (PEO).

How do Employment Solutions work?

The use of employment solutions enables companies to hire employees in Taiwan while outsourcing all employer liabilities including:

- A local compliant labor contract

- Payroll and tax compliance

- Mandatory benefits

- Visa processing (if required)

- Expenses claim administration

Our partner NNRoad is an experienced provider that aims to make the market entry of foreign companies into Taiwan extremely simple by offering services they will require at different stages of their entry. Services they provide include employment solutions, payroll, and tax or mandatory benefits contributions.

Employment Contracts

In Taiwan labor law, an important part is related to the employment contract.

If a company wants to hire foreign employees in Taiwan, there must be a written employment contract between the two parties. An employment contract is crucial for any employment relationship. It protects the legitimate rights and obligations of both employer and the employee.

In recent years, with the rise of employment law disputes, hiring employees in Taiwan has become an increasingly prominent issue. The Labor Standards Act (LSA) is the most important labor-related law which set forth terms and conditions of employment in Taiwan. The LSA can be applied to most types of industries and categories of employees.

In the case of foreign employees working in Taiwan, no matter which country’s governing law has been chosen to be on the employment contract, Taiwanese law must also be applicable. With a few exceptions, foreign nationals must hold a work permit to legally work in Taiwan.

The LSA broadly defines a worker as a person who is hired by an employer to do a job for which wages are paid.

In Taiwan, there are two types of contracts:

- Fixed-term (temporary): Includes but is not limited to seasonal and designated work, temporary, and short-term

- Indefinite-term (permanent) contracts

If an employee has been employed under Taiwanese labor law and the employer requests him/her to work overseas in a different country, the employment relationship will continue to be governed by the labor law of Taiwan unless the original agreement has been terminated.

Elements to include in an employment contract

While there is no standard employment contract template, the following terms should always be included:

- Code of conduct

- Discipline at work

- Working time

- Leaves and vacations

- Remuneration

- Location of work

- Job duties

Upon mutual agreement, an employment contract can be written in Chinese, English, or any other language. In case of any future dispute, a Chinese translation of the agreement along with any supporting documents will be required by the government.

Visas for Expatriate Employees

Because of Taiwan’s political status, steps for obtaining a visa vary between people of different nationalities. If you are looking to obtain an employment visa, longer-term options are appropriate. However, U.S. Passport holders do not need a visa for a short-term stay if their stay is less than 90 days.

The future employer should apply for a work permit through the Council of Labor Affairs. This should be done before an employee is in Taiwan. However, if for some reason the employee is already in Taiwan, it is still possible to obtain a work permit.

The company and the employee will work together to obtain the work permit. Once obtained, the employee should take the work permit to a Taipei Economic and Cultural Office (TECO) in their country and receive a work visa. Most countries (including the U.S.), do not have embassy-level relationships with Taiwan, a TECO office serves as a substitute. A resident visa and a work visa essentially go together, although a resident visa is not required to enter the country. The employee should start working with the TECO office to start the process of obtaining the resident visa.

For a foreign employee interested in staying in Taiwan to work, a resident visa should be obtained. If you begin your time in Taiwan under a visitor visa and want to convert it to a residence permit, the change must be made outside of Taiwan. Many chose to go to Hong Kong for this purpose because of its proximity.

Before an employee applies for a resident visa, they should visit their local Republic of China overseas mission to make the necessary applications before they come. Those who have registered for the normal expansion visa, they can apply to convert it to a residence visa at the National Immigration Agency (NIA).

Within ten days of arriving in Taiwan with your resident visa, a foreigner is required to report to the nearest headquarters of the Foreign Affairs Police to apply for your Alien Resident Certificate (ARC). Resident Visas must be renewed annually.

Foreign employees with a valid regular residence permit who are interested in staying in Taiwan long-term should consider applying for an Alien Residence Certificate (ARC). For a foreign employee to become truly permanent, the Alien Permanent Resident Certificate (APRC), is the appropriate option. This is different from an ARC in that an employee can leave Taiwan for more than half a year and still maintain residency status and continue to enjoy many other freedoms meant for Taiwanese Nationals.

This article gives more information on ARCs and APRCs.

As you can tell, getting the proper paperwork in order is a complicated process, and changes frequently. To assure that everything is done properly, get in touch with us!

Individual Taxation of Employees

Taiwan’s taxation system is multilayered, and it is important to have a correct understanding of the rules which govern employees, whether they are residents of Taiwan or temporary workers.

Individual Income Tax (IIT) Rates

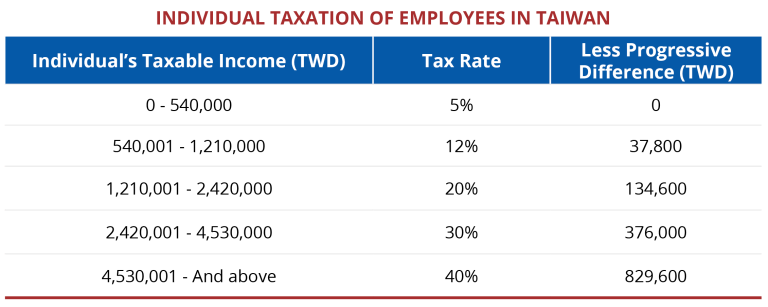

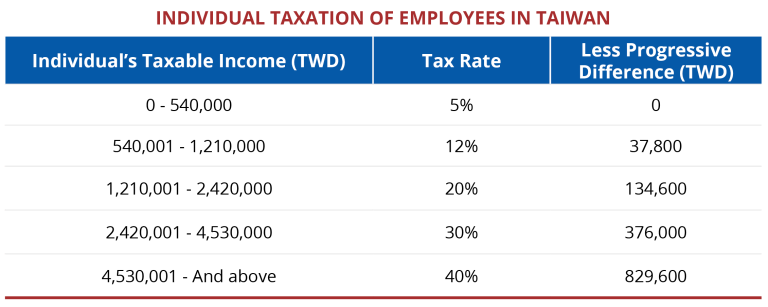

Both residents and aliens who are residents in Taiwan are subject to an IIT tax. The progressive tax rates for 2018 are:

IIT Formula: Tax payable = (Individual’s Income x tax rate % for their bracket) – Progressive Difference for their bracket

Conversion rate January 2019 approximately USD:TWD 1:31

This is the first layer in Taiwan’s resident taxation system for residents, but there is another.

Alternative Minimum Tax (AMT)

As well as regular Income Tax, Taiwan imposes the AMT, which is a flat rate of 20% on residents of Taiwan, including expatriates who live in Taiwan more than 183 days in a year. The AMT includes foreign-sourced income if:

- The alien is a tax resident in Taiwan

- Foreign income equal to or exceeds TWD 1 million and basic income exceeds TWD 6.7 million

To know whether they should pay the AMT, an individual should take their regular taxable income and add back to it certain items including qualified insurance benefits, income derived from private security investment trust funds, non-cash charitable donations, and foreign-sourced income totaling TWD 1 million or more. Although foreign-sourced income increases the AMT burden, foreign taxes paid on foreign-sourced income may be credited against AMT payable, with some limitations.

If the AMT payable amount is greater than the regular income tax payable, the taxpayer must calculate and pay AMT based on this formula:

- Income subject to AMT = Regular taxable income + add-back items

- AMT = (Income subject to AMT – TWD 6.7 million) x 20%

These two laws together, the IIT and the AMT, govern taxation for Taiwanese residents, whether foreign or native workers. For non-resident foreigners, the rules are different.

Non-Resident Foreigners

If an employee stays in Taiwan for less than 183 days, they are considered a non-resident and are subject to a flat rate of 18% of their gross salary earned at the Taiwanese company they work for. This article provides more detail on Taiwan’s tax rates for expats. Taiwan has double taxation agreements with 16 other countries, meaning that taxes paid in one country offset taxes paid in the other. A few of the countries included are the United Kingdom, Australia, and Singapore. It does not have one with the United States.

The Taiwanese system is different than other systems and may feel unfamiliar. To ensure your company can help employees through the taxation process, consider reaching out to us. Our professionals are not only able to provide guidance in this area, but also have many years of experience helping foreign companies through the entire market-entry process in Taiwan.

For more information, including a full list of deductions and exemptions, visit this Taiwanese Government article.

Mandatory Benefits for Residents

Employers in Taiwan are required by law to provide employee benefits. These include setting up employees with social security and paying for health insurance, employment insurance, and labor insurance. Explained below are the employee statutory benefits in Taiwan:

National health insurance (NHI)

National health insurance contribution allocated among the employer (60%), employee (30%), and the government (10%).

Labor insurance

Taiwanese Legal Entities with more than 5 employees must contribute to labor insurance. The labor insurance is shared by the employers (70%), employees (20%) and the government (10%). The maximum monthly insurance salary is TWD 45,800.

Employment Insurance

Companies with at least one employee in Taiwan must contribute to the insurer’s employment service insurance premium.

Social Security

At least 6% of employees’ monthly wages shall be contributed by the employers in Taiwan.

Taiwan, like mainland China, has a Hukou household registration system. However, the system is less strict than on the mainland, and employees’ benefits are not closely tied to it.

Time off from work

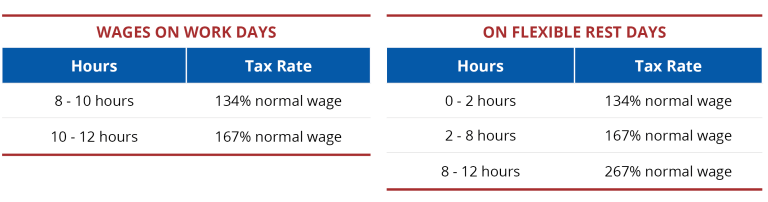

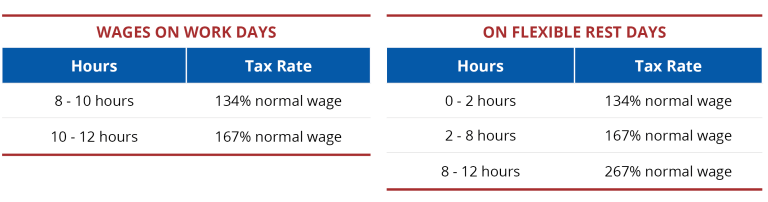

Employers must give employees one regular day off per 7-day work week, along with a rest day. In the past, Taiwanese employees were known for working straight through a 7-day week, but a 5-day week is becoming more normal. Under these new rules, employers must pay a high amount for overtime work.

Employees are permitted to work 54 hours of overtime per month, but not more than 138 hours in a three-month period. Employers may also provide extra leave as compensation for overtime work.

Maternity leave

Female employees have the right to eight weeks of maternity leave. If they’ve been working for the company for longer than 6 months, this leave is fully paid at salary, if less than 6 months, it is paid at 50% of salary.

Annual leave in Taiwan

One benefit for employees in Taiwan are days off for public holidays. Taiwan has 10 of them. They are:

In addition, Employees are entitled to annual leave depending on the time they have worked for a company. If they have worked:

Employment Termination Policies

An employment relationship shall always be terminated in compliance with the LSA’s terms and conditions.

- Employers need to provide advance notice and under special conditions pay severance payment.

- Employees who wish to leave a position are not required to give a minimum number of days’ notice to their employer. Therefore, it depends on the rules set forth in their labor contract. It is often required in the contract that they give one months’ notice.

Severance Pay Rules in Taiwan

The notice must be provided in advance, with the amount of time given based on the duration of employment:

- For the employees who serve more than three months and less than one year, the advance notice should be ten days.

- For the employees who serve more than one year but less than three years, the advance notice should be twenty days.

- For the employees who serve three years or more, the advance notice should be thirty days.

Summary

As a company interested in entering the Taiwanese market, it is crucial to be well-informed of the policies for hiring employees in Taiwan. The island has a complex set of rules; perhaps the most important is that to hire employees, there are two main options: 1) to set up a company in Taiwan and hire employees under this entity, or 2) to use a PEO’s employment solutions to outsource all employment procedures and requirements.

If a company intends to have long-term business plans, it is recommended to set up a foreign company in Taiwan.

For companies planning to test the market and in need to hire local or foreign employees, the use of employment solutions is advised.

Our trusted partner, NNRoad, can help your company to both hire employees in Taiwan, outsource all employer liabilities and set up a foreign company in the country.