Solution for Downsizing in China

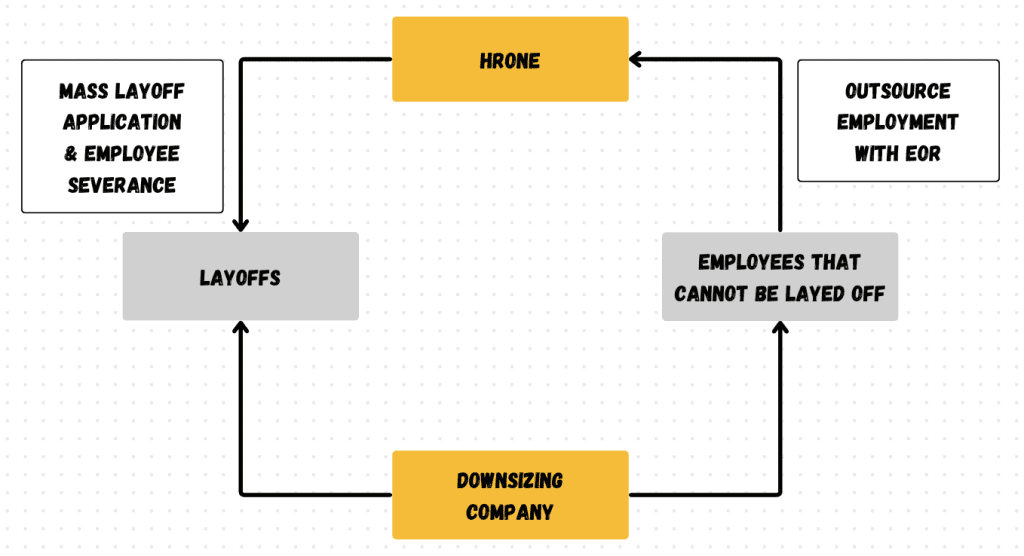

HROne assists companies in downsizing operations so that you are able to make a clean exit while retaining any essential employees on payroll.

How to Navigate downsizing in China

When a company is preparing to downsize, the HR department faces several significant challenges. Downsizing, often a difficult and sensitive process, requires careful planning and execution to minimize negative impacts on both the departing and remaining employees.

Legal Compliance & Risk

- Ensuring the downsizing process complies with all legal requirements, including labor laws and anti-discrimination legislation.

- Managing risks associated with potential lawsuits or legal claims from affected employees.

Severance and Retention

- Deciding which roles and departments will be affected and to what extent.

- Determining appropriate severance packages and support.

Why HROne?

HROne has been doing EOR in China for 18 years and our average tenure is over 7 years. As a trusted provider of Employer of Record (EOR) services in China, we offer a comprehensive solution that simplifies the process of hiring and managing employees in compliance with local laws and regulations.

Local Presence and Knowledge:

With our strong presence in China, we have an in-depth understanding of the local market dynamics, cultural nuances, and business practices.

Comprehensive HR Support:

Beyond acting as your legal employer in China, we offer a wide range of HR support services, all in English.

China Payroll Portal

All of our clients have access to our in-house payroll portal for record keeping convenience.

Frequently Asked Questions

Payroll & mandatory benefits are included in our China Employer of Record and our PEO services.

In many countries, PEO and EOR are the same thing and can be interchanged. However in countries such as China and the USA, PEO and EOR refer to different services:

With Employer of Record (EOR), the service provider takes on the responsibility & liability of the employer since the client does not have a legal entity in the country of interest.

With Professional Employment Organization (PEO), the service provider manages hiring, employment and payroll, but does not take on the responsibility or liability of the employer since the client has a legal entity in the country of interest.

The 13th month bonus in China refers to a bonus equal to one month’s salary that is usually paid at the onset of Chinese New Year.

This 13th month bonus is not mandatory unless explicitly stated in the labor contract upon signing. A 13th month bonus depends on the company’s performance as well as the employee’s performance.

It is possible for employees to receive an even higher bonus (14th or even 15th month bonus) depending on these factors.

Employees in China are entitled to annual leave days based on their work experience.

After working for their employer for 1 year. Employees who have worked less than 10 years are entitled to 5 days paid annual leave.

Employees who have between 10 and 20 years of experience are entitled to 10 days paid annual leave.

Employees with over 20 years of experience are entitled to 15 days of paid annal leave.

Using an Employer of Record/PEO service is often regarded as the modern approach to expanding into China. As long as you do not need to invoice in China, this is a perfect solution for foreign SMEs that want to start their business here. With an employer of record, you can legally hire and manager your team in China, avoiding the time and money required to set up a company.

HROne, the Employer of Record, is legally responsible for your staff during their term of employment in China.

We can hire a local Chinese employee in as little as one day!

Your staff members can be employed and located anywhere in China. Their employment status will be recorded by the local bureau according to their location.

Not necessarily. Staff members can work remotely from home or another location. However, we offer office space rentals upon request.

Yes, our Employer of Record solution can be used to hire both local and foreign staff.

Individual income taxes In China are based on a progressive tax brackets rate:

| Bracket | Annual Taxable Income (RMB) | Tax Rate (%) | Quick Deduction |

| 1 | No more than 36,000 | 3 | 0 |

| 2 | Between 36,000 and 144,000 | 10 | 2,520 |

| 3 | Between 144,000 and 300,000 | 20 | 16,920 |

| 4 | Between 300,000 and 420,000 | 25 | 31,920 |

| 5 | Between 420,000 and 660,000 | 30 | 52,920 |

| 6 | Between 660,000 and 960,000 | 35 | 85,920 |

| 7 | More than 960,000 | 45 | 181,920 |

Social benefits in China are divided into two categories:

- Five mandatory social insurances – These include pension insurance, medical insurance, unemployment insurance, work-related injury insurance, and maternity insurance.

- Housing fund – The purpose of this is to allow employees to save money to buy a house in China.