China presents exciting opportunities for foreign companies looking to expand internationally. To enter the Chinese market, there are several important laws that a company must abide by during the establishment of a local presence. For many foreign companies trying to get the initial foot in the Chinese market, it may be a difficult task due to the lack of knowledge on local regulations and requirements. A FESCO can help.

How to Hire Employees in China through a FESCO

A big one is that in order to hire local or foreign employees, all workers must be employed by a legal entity registered in Mainland China.

Foreign companies can use a FESCO (Foreign Enterprise Service Company) to make their entry into the Chinese market much simpler. First off, a FESCO is fully established and licensed in China as a legal entity.

A FESCO in China can provide local compliance of the Chinese system, navigating through China’s HR and employment requirements by outsourcing and managing all administrative procedures. So, how can a FESCO assist your company? There are two ways, the one to choose depends on your company’s legal situation in China.

Companies without a Legal Entity in China

Many foreign companies only need to hire employees in China during the initial stage. A FESCO is a great solution for these companies as it provides employment solutions; a total employment package that embraces all employment liabilities. From the signature of a local compliant contract to payroll, from mandatory benefits administration to tax contributions, as well as visa processing and other optional features such as expense claim management or medical insurance, using a FESCO is an inclusive solution.

Furthermore, the use of a FESCO’s Employment Solutions enables foreign companies to increase or decrease their employee headcount in China with high flexibility, as the procedure is simplified to onboarding new employees or terminating them through the local FESCO Chinese agency.

In addition, this market entry model is fully compatible with longer-term plans for companies wishing to set up a foreign-owned company (WFOE), as all employment relationships can be transferred from the Chinese FESCO agency to the new foreign entity.

Companies with a Legal Entity in China

A FESCO agency in China can also act as a strong local partner for any company that already has a legal entity in China (WFOE). The compliance of the various administrative requirements imposed by the Chinese authorities in such a constantly-changing market may result in a challenging task for foreign companies.

How can a FESCO in China support foreign companies?

How a FESCO in China can Support All HR Requirements

Regional HR laws and regulations must be taken into consideration when conducting payroll and taxation operations in China. The taxation system changes frequently and can be especially confusing for foreign companies, so local knowledge is valuable and recommended.

Individual Income Tax

Recently, several changes were made to China’s Individual Income Tax (IIT) laws. These changes were made to simplify the rules and provide tax breaks to those struggling to keep up with China’s rapidly growing cost of living, as well as increase consumption during a time of slow international trade growth for China. Unfortunately for foreign and higher-income employees, the new laws take a tougher stance.

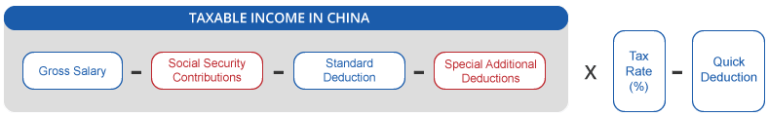

For simplicity’s sake, here is the formula to calculate IIT in China:

Special Deductions

The standard deduction has increased for both non-resident and resident taxpayers. It used to be RMB 4,800 and RMB 3,500 respectively, it is now a unified RMB 5000 per month, meaning that the total annual deduction is now RMB 60,000.

There are additional special deductions available:

- Housing rent (RMB 18,000, RMB 13,200, or RMB 9,600 per year, depending on the city);

- Education expenses for children (RMB 12,000 per year per child);

- Expenses for further self-education (RMB 4,800 or RMB 3,600 per year, depending on the city);

- Housing loan interest (RMB 12,000 per year);

- Healthcare costs for serious illness (Bill from the hospital must be from RMB 15,000 per year to RMB 80,000 per year);

- Support for the elderly (RMB 12,000 to RMB 24,000 per year, depending on whether support is given individually or with help from siblings).

There is also a new charity deduction, if an individual donates up to 30% of their income to certain causes, this amount can be deducted from their taxable income.

The new IIT regulations also provide incentives for certain types of income. Income from labor services, income from royalties, and income from the author’s remuneration is given a 20% discount prior to being calculated in someone’s pre-tax income. The author’s remuneration will be subject to an additional 30% discount.

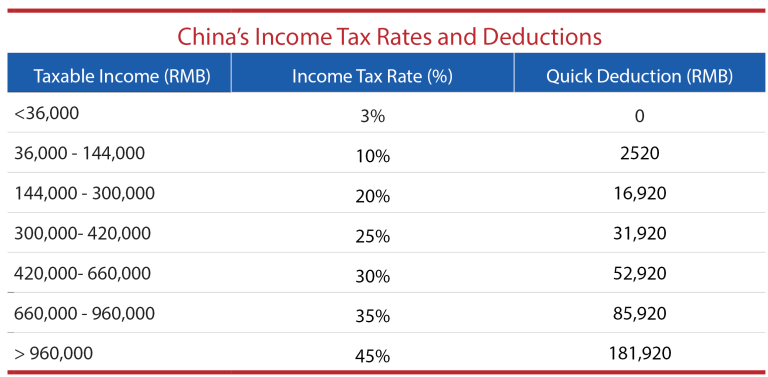

Below is a table explaining the tax brackets, put in terms of yearlong income:

From this table, it is apparent that the lower brackets have been widened, while the upper brackets remain unchanged. This means that a greater amount of people will have a lower IIT rate. However, for most foreigners, their IIT rate will remain the same, although they can still take advantage of the new deductions.

Social Security’s Mandatory Contributions

Mandatory benefits are an important factor in employee compensation in China, but the process of administering them is far from simple.

In China, social security is divided into two parts: one is social insurance (composed of 5 types of insurance) and the second is the housing fund.

Social Insurances

The five social insurances are:

- Pension – Both employees and employers should contribute. An employee’s part goes into a personal account and is considered personal property, so it is inheritable. A pension cannot be drawn on until after the employee has worked for 15 years.

- Medical – Heavily subsidized by the state, although the employee and employer still contribute. It does not cover all expenses or treatments, and an employee’s dependents are not covered.

- Unemployment – This is obligatory insurance in China, and it can cover unemployed urban workers for up to 24 months. It is funded by both employee and employer contributions.

- Work injury – This is covered completely by the employer. It covers medical expenses, as well as wages for up to 12 months.

- Maternity – Also funded by the employer. Covers medical expenses and loss of earnings for no less than 90 days.

The Housing Fund

The housing fund was created by the government in 1999. It differs from the other social insurance because employees do not draw on a pool of money, instead of contributing to their own personal fund.

Employers and employees usually contribute evenly to the fund, each contributing anywhere between 5% to 25%. This is mandated by the Chinese government, and if employers do not set one up or contribute to it, they will be fined. Employees can pull money from this fund for house ownership purposes, but not for paying rent. When employees retire, they can withdraw the full amount and use it however they want.

- The contributory rates vary from city to city and from employer to employer, so an accurate understanding of the appropriate local laws is crucial. Contributions may vary based on China’s Hukou system of registration, so employers should make sure they are aware of the relevant rules.

Visa Processing

A FESCO can help with the immigrational process required by Chinese authorities. A work visa application in China is a synonym to a lengthy and complex procedure due to the increasingly difficult requirements imposed. In addition to obtaining a residence permit, all foreign employees must also have valid work permits. The work permit process is complex, with three and corresponding requirements. A FESCO can make sure employees’ applications are correct and submitted smoothly.

The Benefits of Working with FESCO

Legal Compliance and HR Support

One of the key benefits of working with a Foreign Enterprise Service Company (FESCO) in China is the legal compliance and HR support they provide. China’s complex legal and regulatory environment can be challenging for foreign companies to navigate on their own. FESCOs have extensive knowledge of Chinese labor laws and regulations, and they can help foreign companies ensure compliance with local laws and regulations. Additionally, FESCOs can provide HR support, including recruitment, payroll management, and employee benefits administration. This support can be invaluable for foreign companies looking to establish a presence in China without having to establish a local HR department.

Cost-effective

Another key advantage of using a Foreign Enterprise Service Company (FESCO) in China is the cost-effectiveness it offers to foreign companies. Setting up a local entity in China can be expensive due to the high costs of office space, staffing, legal compliance, and administrative overhead. By contrast, using a FESCO allows foreign companies to establish a presence in China quickly and cost-effectively.

FESCOs typically offer a range of services at a fixed monthly fee, which makes it easier for foreign companies to manage their budgets and avoid unexpected expenses. Additionally, FESCOs can help foreign companies save money on recruitment and staffing by providing access to a pool of talented and skilled workers at competitive rates.

Another cost-saving benefit of using a FESCO is the ability to avoid the costs associated with terminating employees in China. Under Chinese labor laws, terminating employees can be a complex and expensive process that requires compliance with strict regulations. FESCOs can help foreign companies avoid these costs by providing contract-based staffing solutions, which allows companies to quickly adjust their workforce to meet changing business needs without incurring additional costs.

In short, using a FESCO in China can be a cost-effective way for foreign companies to establish a presence in the country while avoiding the high costs associated with setting up a local entity. The fixed monthly fees, access to skilled talent, and the ability to adjust the workforce easily and quickly all contribute to the cost-saving benefits of using a FESCO in China.

Access to Talent and Skilled Workforce

One of the primary advantages of using a Foreign Enterprise Service Company (FESCO) in China is the access to a pool of talented and skilled workers. FESCOs have established relationships with a wide range of local talent and can provide foreign companies with access to highly skilled professionals, including engineers, IT specialists, and other technical experts.

Moreover, FESCOs can help foreign companies overcome the challenges of recruiting and retaining top talent in China. Due to the highly competitive labor market, attracting and retaining top talent can be a significant challenge for foreign companies. FESCOs can help foreign companies overcome this challenge by providing comprehensive HR support, including employee benefits, payroll management, and career development programs.

FESCOs can also provide foreign companies with a deep understanding of the local labor market and regulatory environment. This knowledge can be invaluable in identifying the best talent and ensuring compliance with local labor laws and regulations.

In addition, FESCOs can provide training and development programs for employees, ensuring that they are equipped with the necessary skills and knowledge to be successful in their roles. This can be especially beneficial for foreign companies operating in highly technical industries where specific skills and knowledge are essential.

In conclusion, using a FESCO in China can provide foreign companies with access to a pool of highly skilled and talented professionals, as well as the support and knowledge necessary to recruit and retain top talent in the highly competitive Chinese labor market.

Operational Flexibility

Operational flexibility is another benefit of using a Foreign Enterprise Service Company (FESCO) in China. FESCOs can provide foreign companies with the flexibility to adjust their workforce and staffing levels quickly and easily, depending on business needs. This is especially important for companies operating in industries with fluctuating demand or seasonal fluctuations in workload.

FESCOs offer flexible staffing solutions, including short-term and long-term contracts, project-based staffing, and temporary staffing. This allows foreign companies to adjust their workforce according to business needs without incurring additional costs associated with recruiting and terminating employees.

Moreover, FESCOs can provide additional operational flexibility by managing administrative tasks, such as payroll management, employee benefits administration, and legal compliance. This can free up valuable time and resources for foreign companies, allowing them to focus on their core business operations and strategic growth initiatives.

In conclusion, the operational flexibility provided by FESCOs can be a significant advantage for foreign companies operating in China. The ability to adjust the workforce quickly and easily can help companies stay agile and responsive to changing market conditions, while the administrative support provided by FESCOs can help free up resources for strategic growth initiatives.

Risk Mitigation

Using a Foreign Enterprise Service Company (FESCO) in China can help foreign companies mitigate risks associated with establishing a presence in a foreign market. FESCOs have extensive knowledge of Chinese laws and regulations, and can help foreign companies ensure compliance with local laws and regulations. Additionally, FESCOs can help foreign companies manage risks associated with labor laws and employee relations, as well as tax and financial regulations. By working with a FESCO, foreign companies can have peace of mind knowing that they are operating in compliance with local laws and regulations and are reducing their exposure to potential risks and liabilities.

FESCO vs. Traditional Employment

Differences between FESCO and traditional employment in China

There are several differences between using a Foreign Enterprise Service Company (FESCO) and traditional employment in China. One key difference is that FESCOs provide a range of HR services, including recruitment, payroll management, and benefits administration, while traditional employment typically requires the employer to manage these tasks internally. Additionally, FESCOs are often better equipped to handle compliance with Chinese labor laws and regulations, reducing the risk of legal issues for foreign companies. Finally, FESCOs can provide more flexibility in terms of staffing, allowing foreign companies to adjust their workforce quickly and easily based on business needs.

Advantages of using FESCO over traditional employment

There are several advantages to using a Foreign Enterprise Service Company (FESCO) over traditional employment in China. FESCOs provide comprehensive HR services, allowing foreign companies to focus on their core business operations while leaving HR tasks to the experts. FESCOs also provide flexibility in terms of staffing, allowing foreign companies to adjust their workforce quickly and easily based on business needs. Additionally, FESCOs are well-versed in Chinese labor laws and regulations, reducing the risk of legal issues for foreign companies. Finally, FESCOs can provide administrative support, including payroll management, benefits administration, and visa and work permit applications, further reducing the burden on foreign companies.

Licensed FESCO Company in China

Having the support of a FESCO in China is critical for foreign companies because in this way these can outsource HR and administrative processes to these agencies, saving costs and time to operate the business.

One important thing to keep in mind is that a FESCO in China shall be licensed by the government, in order to legally offer these services. And foreign investors must be careful when choosing the provider and check in advance if the agency has or not the required licenses.

There are many different Foreign Enterprise Service Company options out there for foreign companies entering China. HROne is one of the few licensed FESCO company in China that can offer HR outsourcing services. We have many years of experience helping companies from a variety of industries enter the Chinese market.

We specialize in walking companies through the whole process, from the initial start to the long-term support phase. Even before you have a legal entity in China, we can hire employees to get operations started. Then, when you are further along in the process and have your own legal entity, we can manage your employees’ full payroll liabilities, from disbursing monthly salaries to complying with the individual income tax and social security contributions.

Doing administrative tasks in China can be time-consuming and confusing, and so many foreign companies choose to let an established provider take care of those services for them.