China is increasingly attracting more foreign investment into the country, the number of companies opening subsidiaries in China is increasing. Consequently, the need to hire employees in China and subsequently understand local labor laws is an important facet to consider when doing business in China.

Failure to comply with these local labor regulations can cost companies time, money, and most importantly legal problems. The extensive and complex nature of Chinese laws, policies, and regulations in regards to labor make this a daunting operation for non-experts.

In today’s guide, we dive into payroll in China as it stands in 2022, all of the mandatory compliance payroll points, benefits & compensation, insurance, taxes, union fees, how to calculate total costs, taxes and more!

Structure of Labor Cost / Employee Payroll in China

This section contains information that will answer employee salary-related questions, such as: “What is China’s salary structure?“, “What is the total cost for hiring an employee in China?”, “How is the salary calculated in China?” But to understand all these questions, there are some terms that we must understand in regards to employee salary in China.

What’s the definition of the monthly gross salary?

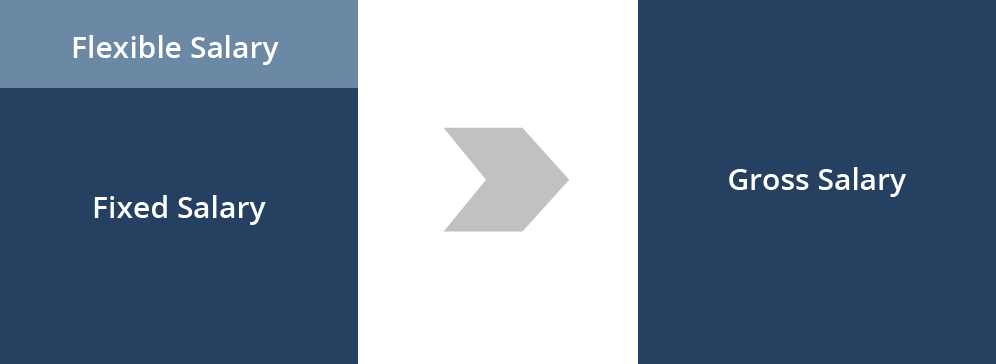

Gross salary is the amount of money that comes before the deduction of the individual income tax and the employee’s contribution of statutory benefits. Employee’s monthly gross salary consistent of two parts: fixed salary and flexible salary.

Fixed salary: a fixed amount stated in the employment contract.

Flexible salary: this normally refers to the commission, bonus, allowance, overtime payment, or any other changeable amount that is not fixed and may vary from month to month.

How much should my employee receive as the monthly net salary?

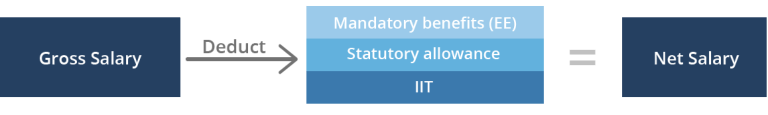

Net salary refers to the amount of money that comes after the deduction of taxes and other deductibles such as insurance or benefits. In short, it is the total amount of money that an employee takes home at the end of the day.

In China, each employee is required to contribute towards their mandatory benefits, while also paying the individual income tax, both will be taking from their monthly gross salary.

During each payroll cycle, the employer shall calculate each employee’s mandatory benefits contribution base, which will also depend on each individual city’s contribution base and rate policy. It is the employer’s role in China to calculate and contribute the mandatory benefits and individual income tax on behalf of the employee.

What is my total monthly payroll cost for hiring an employee in China?

Employer’s contributions to the mandatory benefits shall be added up to the monthly payroll calculation. As presented below, the structure of your monthly employee hiring cost should be clear and concise.

Note: “ER” refers to employer and “EE” refers to the employee

Part Two: Mandatory Benefits – Social Insurance And Housing Fund

Hiring an employee in China may generally increase 35-40 percent more than the employee’s monthly gross salary due to the mandatory benefits contribution.

What are the mandatory benefits in China?

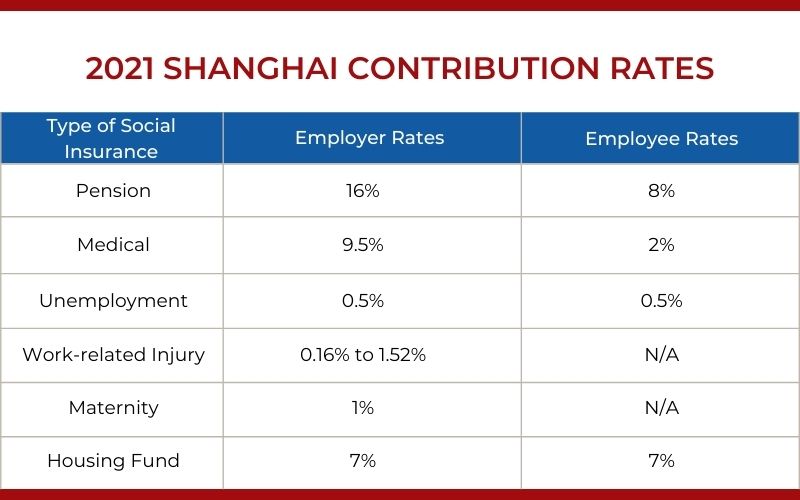

Mandatory benefits shall be contributed by both employers and employees in China and it shall be consistent with the five social insurances and the one housing fund. The below chart helps you to understand the employee and employer’s portion of the mandatory benefits.

The Chinese mandatory benefit contribution is a very complex system. In China, each individual province and city has its own contribution policies and bases. As a foreign company operating in China, compliance with PRC laws is extremely important. Foreign companies should be very familiar with local policies where your company is located and be very careful about the policy updates and changes.

So how is the monthly calculation of mandatory benefits? First, you must learn and understand the definitions of contribution base, contribution rate, and the calculation formula. Understanding these definitions is a vital part of paying your employee’s mandatory benefits.

What is the mandatory benefits’ contribution base?

When you hire a new employee in China, you must declare your employee’s mandatory benefits contribution base during the first month via the local government system. The contribution base will then be adjusted in each individual city for each year.

- For new employees: 1st month’s salary will be their contribution base

- For normal employees (2nd year of contribution): employee’s monthly average salary of the previous year will be their contribution base.

Both are limited by: Maximum and Minimum base

The maximum and minimum contribution bases differ from city to city, thus the base will be announced by the local government annually. Taking Shanghai 2021 Contribution Base as an example:

- Maximum contribution base: CNY 31,014

- Minimum contribution base: CNY 5,975

What are the mandatory benefits’ contribution rates?

The contribution rates are also different from city to city. Below is an example of the Shanghai contribution rates for both employer and employee in 2021.

What is the mandatory benefits calculation formula?

Contribution Amount= Contribution Base x Contribution Rate

The following is the contribution amount for one employee’s basic gross salary of RMB 10,000 in Shanghai as an example.

Part Three: Individual Income Tax

What is the basic individual income tax calculation formula?

Monthly Taxable Income= Gross Income – IIT Exemption Threshold

Individual Income Tax Payable= Monthly Taxable Income x Applicable Tax Rate – Quick Deduction

Note:

- Gross Income: After deduction of employee mandatory benefit (social insurance & housing fund)

- IIT Exemption Threshold: 5,000 per month, 60,000 per year

What is the latest individual income tax rate in China?

Due to the modification of the Chinese Individual Income Tax policy, the taxable amount and tax rate are calculated changing from monthly to annually. Below is the latest tax rate:

2021 China Tax Rate (RMB)

| Grade | Annual Taxable Income | Tax rate | Annual quick deduction |

| 1 | 0 – 36,000 | 3% | 0 |

| 2 | 36,001 – 144,000 | 10% | 2,520 |

| 3 | 144,001 – 300,000 | 20% | 16,920 |

| 4 | 300,001 – 420,000 | 25% | 31,920 |

| 5 | 420,001 – 660,000 | 30% | 52,920 |

| 6 | 660,001 – 960,000 | 35% | 85,920 |

| 7 | Above 960,000 | 45% | 181,920 |

What is an example of an individual income tax calculation?

Here is one simple example of the employee’s IIT tax calculation, which is based on Employee A’s January, February, and March’s taxable income is RMB 30,000 each month (already deduct the IIT exemption, mandatory benefits, and no specific additional deductions), below is the calculation details of how much IIT shall be calculated in Jan, Feb, and Mar:

January:

Annual taxable income: 30,000

Applicable tax rate: 3%

IIT for January= 30,000*3%-0=900

February:

Annual taxable income is accumulated: 60,000

Applicable tax rate: 10%

Accumulated Yearly IIT: 60,000*10%-2520=3480

IIT for February= Accumulated Yearly IIT-IIT for January=3480-900=2580

March:

Annual taxable income is accumulated: 90,000

Applicable tax rate: 10%

Accumulated Yearly IIT: 90,000*10%-2,520=6,480

IIT for March= Accumulated Yearly IIT-IIT for Jan-IIT For Feb=6480-900-2580=3,000

Specific additional deductions that help employees to save the tax contribution

Yes, according to the new tax laws that already come into effect, an employee is entitled to benefits not only of the RMB 5,000 tax exemption each month, but they also are also entitled to additional deductions under the following requirements, which reduced their contribution towards the individual income tax. Below are the specific additional deductions:

- Expenses for children’s education

- Expenses for further self-education

- Healthcare costs for serious illness

- Housing loan interest

- Housing rent

- Elderly care expense

It is the employees’ responsibility to declare their specific additional deduction through the government official tax system, website, or app in a timely manner. Once the declarations have been submitted by the employee, the employer is able to get the information through and system and shall apply the deductions towards the individual income tax when calculating the monthly salary and.

How to calculate the individual income tax if my employee applies the specific additional deductions?

Below is an example that helps you to understand the calculation:

Background:

In 2019, one employee’s monthly gross salary in each month is RMB 30,000;

The monthly IIT exemption deduction is: RMB 5,000;

Monthly employee’s mandatory benefits deduction is: RMB 4,500;

Employee apply specific additional deductions that adds up to RMB 2,000 (One for children’s education and one for supporting the elderly)

The individual income tax payable in the first three months are calculated below(RMB):

January: (30,000-5,000-4,500-2,000) *3% = RMB 555;

February: (30,000 *2-5,000 *2-4,500 *2-2,000 *2) *10% -2,520-555 = RMB 625;

March: (30,000 *3-5,000 *3-4,500 *3-2,000 *3) *10% -2,520-555-625 = RMB 1,850

Biggest Changes After the China Tax Reform in 2019

Foreign companies shall know that under the new tax policy in 2019, the taxable amount and tax rate is calculated from monthly to annually. The monthly tax amount is calculated based on the annual taxable amount until the current month minus the tax of previous months.

Using this calculating method, as time passes and the annual income accumulates, the tax rate level will go up, Therefore, even if the monthly gross salary remains the same, the monthly tax amount will increase while the monthly net salary will decrease. This calculating method does not change the overall annual taxable amount nor the annual tax amount.

Due to the complexity and changing policies in China, foreign companies do need to fully understand these policies when handling employee’s payroll and salary or outsource the payroll to a professional agency to ensure legal compliance and focus on their main business.

Compliance and Reporting Requirements

A. Monthly and Annual Reporting Obligations

Monthly and annual reporting obligations are crucial aspects of payroll management in China. Employers are required to fulfill these obligations to ensure compliance with local regulations and maintain transparent financial records. Monthly reporting typically involves submitting reports to the tax authorities, social insurance agencies, and housing fund management authorities. These reports detail the payroll information of employees, including income, tax deductions, social insurance contributions, and housing fund contributions.

Annual reporting, on the other hand, includes the preparation and submission of year-end tax returns and financial statements. Adhering to these reporting obligations is essential for businesses operating in China to meet their legal requirements and avoid potential penalties or legal issues.

B. Document Retention and Record-Keeping

Document retention and record-keeping play a vital role in ensuring compliance and transparency in payroll management in China. Employers are required to maintain accurate and complete records related to employee payroll, including employment contracts, tax declarations, social insurance documents, housing fund records, and payroll reports. These records must be retained for a specific period as mandated by local regulations.

Proper document retention and record-keeping practices not only demonstrate compliance with legal requirements but also enable businesses to track and verify payroll transactions, resolve disputes, and facilitate audits. Effective record-keeping ensures transparency, accountability, and smooth operations, providing a solid foundation for managing payroll in China.

Ensuring Payroll Compliance in China

A. Staying Updated with Regulatory Changes

Staying updated with regulatory changes is essential for managing payroll in China effectively. The Chinese government frequently introduces new laws, regulations, and policies that impact payroll-related matters. These changes can include updates to tax rates, social insurance contribution requirements, housing fund policies, and other aspects of payroll calculation and compliance.

To stay informed about regulatory changes, employers should establish reliable channels for receiving updates. This can involve subscribing to official government newsletters, following reputable industry publications, joining professional networks or associations, and leveraging online resources provided by government agencies. It’s crucial to ensure that the sources of information are reliable and up-to-date.

Regularly monitoring and reviewing regulatory updates is essential. Employers should pay attention to official announcements, circulars, and notifications issued by relevant authorities such as the tax department, social insurance agencies, and housing fund management offices. These updates often include details on changes in tax rates, contribution thresholds, reporting requirements, and deadlines.

Additionally, attending seminars, workshops, and training sessions conducted by experts in the field can provide valuable insights into regulatory changes and their implications for payroll management. Consulting with local legal and accounting professionals who specialize in payroll matters can also be beneficial, as they can provide guidance tailored to specific business needs and ensure compliance with the latest regulations.

By staying proactive and informed about regulatory changes, employers can adapt their payroll processes promptly, avoid potential compliance issues, and ensure accurate and up-to-date payroll calculations for their employees in China.

B. Seeking Professional Advice and Services

Seeking professional advice and services is a prudent approach when managing payroll in China. The complexities and ever-changing nature of local regulations and tax laws necessitate expertise to navigate through the intricacies of payroll calculation and compliance. Here are key reasons why engaging professional advice and services is beneficial:

- Expertise and Knowledge: Payroll professionals possess in-depth knowledge of Chinese payroll regulations, tax laws, and social insurance requirements. They stay updated with the latest changes, ensuring accurate calculations and adherence to legal obligations.

- Compliance Assurance: Professionals can help businesses ensure compliance with complex and evolving regulatory frameworks. They understand the intricacies of payroll-related laws, such as income tax rates, social insurance contributions, and housing fund policies. Their expertise minimizes the risk of non-compliance, penalties, or legal issues.

- Time and Resource Efficiency: Outsourcing payroll services or consulting with professionals frees up valuable time for businesses to focus on their core operations. Professionals handle payroll tasks, such as calculating deductions, preparing reports, and filing taxes, allowing organizations to allocate resources more efficiently.

- Accuracy and Error Reduction: Payroll professionals employ established systems and procedures to ensure accuracy in payroll calculations. Their expertise minimizes the chances of errors, discrepancies, or miscalculations that could lead to financial loss or employee dissatisfaction.

- Confidentiality and Data Security: Professionals adhere to strict data privacy and security protocols, safeguarding sensitive employee information. Outsourcing payroll services ensures that data is handled securely and confidentially, mitigating the risk of data breaches or unauthorized access.

- Customized Solutions: Payroll professionals can tailor their services to meet the specific needs of businesses. They understand the unique requirements of different industries and provide solutions that align with the organization’s payroll management objectives.

- Scalability and Flexibility: Professional payroll services can adapt to the changing needs of businesses, whether it involves accommodating workforce growth, handling employee benefits, or addressing payroll challenges associated with mergers or acquisitions.

By engaging professional advice and services, businesses in China can optimize their payroll management, reduce administrative burden, ensure compliance, and focus on strategic initiatives for growth and success.

China Payroll Calculation

Use HROne’s payroll calculator to have an estimation of the total cost of employment of your employees in China.

We are Your HR and Payroll Partner in China

We are a leading payroll and HR provider in China. We help foreign companies comply with their local payroll, tax, and mandatory benefits requirements while relieving them from all administrative and HR operations. Our services support any foreign company whether they have a legal entity in China or not.

- China Payroll services: For companies with a legal entity in China who need payroll outsourcing services. HROne handles the full payroll cycle every month including salary disbursement, income tax deduction, and social security contributions.

- PEO / Employer of Record: For companies without a legal entity in China. This service enables foreign companies to hire employees in China, while HROne handles all employment and HR operations (local labor contract, payroll, and tax, mandatory contributions, visa processing, etc).

Conclusion

Hiring employees in China comes with responsibilities in terms of salary, social benefits, taxes. Understanding those is important in order to not making mistakes and being compliant in China.

Read our articles to know more about it: