China is a market with uncertainties and risks so it is important to understand these risks before committing to an investment.

But China is also full of opportunities for those companies that are willing to spend time to understand how the country works and how the Chinese consumers think when they buy.

This article discusses the risks for companies in China, and the precautions needed to reduce these risks so that business successes are not impacted by them. It also shows you a solution to avoid uncertainties and risks when building a business in China.

China is still a hot market

Before talking about the main challenges, I want to put in evidence one thing.

China is still a hot market. Why?

In the graph below, we can see the trend of foreign direct investment in China in the last 10 years. As we can see, also during the peak of the COVID in 2020, companies were still investing in China.

Recent data shows that foreign direct investment flows to China rose by 22.3 percent year on year to $113.7 billion from January to August 2021.

In detail, plus 25.8% in the service industry, with foreign investment in the high-tech services sector rising 35.2 percent.

The FDI in China is only one reason that shows why the country is still attractive for foreign companies. But other factors contribute to this:

- A rising consumer class: more and more young people and millennials are growing in China. They are starting to consume more of their income and actually their spending power is set to more than double in 10 years.

- Stable government: Political and economic stability are an important drive for growth. China has always guaranteed a stable government, with opportunities to evolve and develop even more.

- Regulatory environment – the Chinese government promotes investment in commercial and entrepreneurial activities by providing attractive financial incentives in the form of tax breaks, grants, low-cost government loans.

Risks when building a business in China

As I said, China is still an attractive market but with more uncertainties and risks.

COVID brought many problems last year and it is actually still a problem if we consider the recent surge in the Delta cases.

But it especially caused the country to close because of the risk of importing cases from abroad. There are currently strict quarantine policies if you want to come to China and it is hard to get a working visa, business visa, or tourist visa.

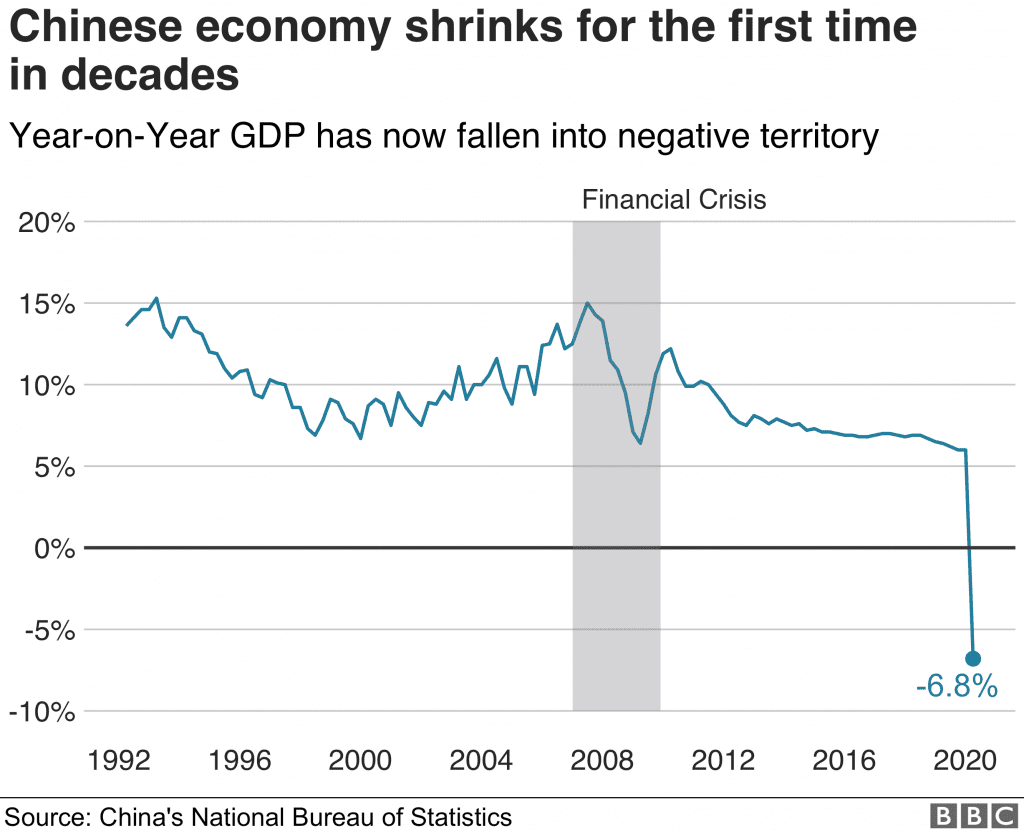

The GDP of China shrank for the first time in decades because of the pandemic in 2020.

Another element that caused uncertainties is the trade war with the USA. It started in 2018 and many tariffs imposed remain in place on most Chinese goods.

Talking about the challenges and risks of doing business in China, I want to highlight other aspects that companies have to consider:

- Market access

Local distribution networks, buying habits of local consumers, and regulatory requirements can make China a very difficult market to access.

- Laws and regulations

Chinese laws and local compliances are complicated. The process of entering the market and setting up a local entity, for example, can be tiresome and costly.

- Managing sales and distribution

With 1.4B people, there is a customer in China for any product in the world. The challenge is finding the right distribution channels to reach them and knowing how to manage these channels.

- Government issues

Many businesses expanding to China have faced issues relating to government procedures.

- HR and payroll

Difficulties in hiring the right employees, managing HR, social benefits, and tax requirements have always been a top challenge for many foreign businesses in China.

- High competition

The competition in Chinese markets is massive. More companies are entering China for their global expansion, and local businesses are booming parallelly.

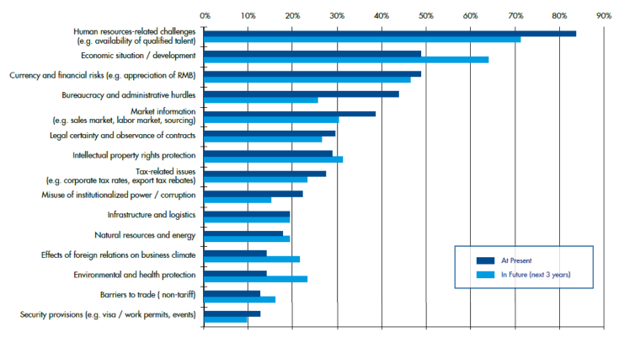

The graph below from the European center for small and medium businesses shows more about the challenges that companies in China are facing. We can see at the top problems are HR problems, economic situation, financial risks, administrative hurdles.

The conclusion is that there are indeed many challenges for businesses operating in China, some of them are recent problems, some of them are more long-term problems that companies are struggling with.

But China is still full of opportunities and one of the biggest markets in the world. Consumer spending power is rising and foreign products are accepted by consumers.

And there is a way to access this market in a low-risk way…

How a PEO/EOR can help your company to avoid uncertainties and risks in China

I want to introduce to you one way that you can use to reduce the uncertainties that I mentioned before.

The traditional method of entering China is with a company. Opening a company is usually the default thought that businesses and individuals have when approaching China.

Many of our clients also came with this idea at the beginning. They wanted to open a Representative Office or a WFOE and start operating in China.

The problem with that is about the cost and time to spend on this process.

For example, opening a WFOE requires a big investment and it can take 3-4 months to register (if you don’t have problems with the registration process or with the government).

After that, you also have to consider the taxes to pay, hiring employees, and paying the employment cost, and you are directly responsible for everything that happens if things don’t go well.

A representative office is not a good option either because it actually allows you to conduct only non-profit-making activities and it requires the same time to open. Besides this, you also have to consider risks to handle if something doesn’t go as planned or if you have to close it.

The new way to start a business in China is to use a PEO/EOR solution.

Before going into details of what it is, I want to briefly explain what is the difference between a PEO (Professional Employer Organization) and an EOR (Employer of Record). The terminology is actually very similar. While in the USA and other European countries there is a difference between PEO and EOR, in China this differentiation does not exist.

A Professional Employer Organization (PEO) is an employment solution for companies that hire staff in China.

The PEO/EOR becomes the legal employer for your workforce, taking over compliance, tax, and payroll responsibilities.

One of the main benefits of using this kind of solution is that it allows you to start a business in China without setting up a local company, and this can greatly reduce many of the risks that I mentioned earlier.

Simply put, a PEO/EOR solution legally employs your staff in China on your behalf while you don’t have a legal entity established in China and seconds them back to you under a service agreement.

With this arrangement, the PEO/EOR service provider becomes the employer of record in China, bypassing the tedious process tied with setting up a legal entity in China and making expansion into the market much simpler.

A PEO offers specifically these services:

- Human Resource Services – PEO takes charge of all the HR aspects. Because of the expertise in local laws and regulations, a PEO can assure that foreign companies operating in the country are compliant with the law regulating the labor contracts and all the employment aspects.

- Sign Employment Contract– After the client company drafts the employee’s labor conditions (salary, bonus, benefits, leaves, etc.), the HR service provider prepares a bilingual employment contract in compliance with local labor laws. After this, the HR provider signs the labor contract with the staff based in China.

- Benefits Administration – Mandatory benefits are an important factor in employee compensation, but the process of administering them is far from simple. In China, for example, social security is divided into two parts: one is social insurance (composed of 5 types of insurance) and the second is the housing fund. A PEO handles this aspect plus the administration of allowances, vacation pay, sick leave, and other benefits provided by the client company.

- Payroll Services – The payroll process is the procedure that organizations or companies do to pay their employees. Payroll in China, for example, involves the payment of an employee’s salary, handling the mandatory benefits (social security), Individual Income Tax deduction, payment of annual bonus, Overtime Payment (if applicable), etc. A PEO can handle the payroll process in a manner that complies with the local jurisdiction and make payments to employees.

- Visa Processing – A PEO can help with the immigration process required by Chinese authorities. In addition to obtaining a residence permit, all foreign employees must also have valid work permits. The work permit process is complex, with three and corresponding requirements. A PEO can make sure employees’ applications are correct and submitted smoothly.

When a PEO/EOR is the best solution to use

In general, a PEO is a solution that can be used by both companies already operating in China or that don’t have a company set up in the country.

This is because the PEO can help to reduce the HR and administrative risks and costs that come when operating in China.

In the specific, we have four situations where a PEO is the best solution:

- Sell products in China – This applies mainly to B2B companies if you don’t need to invoice in China in RMB. You can invoice in your own country and hire staff here to manage your sales or marketing activities to promote your products or services. This is a cost-effective solution because you don’t have to go through all the process of setting up a company, but you can efficiently find local employees and the only cost to sustain is the labor cost.

- Sourcing from China – This is another situation where a PEO becomes an effective solution. Instead of going through the traditional method of setting up a WFOE to manage all the operations, you can hire employees through the PEO to manage all the relationships with local providers. For example, you can hire quality control employees to check products to source or managers to negotiate prices with factories.

- Testing the local market – In this case, it is useful to use a PEO so you can hire sales, marketing, business development staff to conduct market research and understand better if expanding in China is the right solution for your business. It is a very flexible option and especially useful in the short term.

- Hire local talents – Sometimes companies need to on-board local staff to handle ground operations or hire contractors in China. The only way to do that traditionally would be to set up a company to hire and pay the staff. But doing that through a PEO, especially in case of contractors and short term roles, saves time and costs and effectively reduces the business risk.

Procedure to use a PEO/EOR solution in China

As we mentioned, the PEO takes care of everything related to HR, employment, and payroll for your company in China.

I will shortly highlight below what is the procedure to use a PEO in China:

- The client identifies the candidate to hire

- PEO verifies the eligibility of the employment (CV, health check, background check

- PEO hires the employee signing the employment contract

- PEO and employer onboard the employee

- The employer manages the daily tasks of the employee

- PEO manages HR and payroll

- PEO is responsible for employment-related communication with the government

- PEO is responsible for the compliance

- PEO and employer handle employment issues

- In case of termination, the employer bears the cost and the PEO handles the termination process

Conclusion

Entering the Chinese market became challenging for the reasons explained in the article. But the country recovered immediately after the first wave of COVID-19 and reaching a high level of growth. Many opportunities to invest are still waiting for foreign companies.

As a registered PEO in China, we can help your company to enter the Chinese market in a low-risk way. We can help you to recruit talents in China, run compliantly your payroll, and outsource your HR processes.

Contact us if you need more information or a free quote!